“Exploding

debt in 2012 at 340.6 Billion Euros, compared to an initial estimation of 316

Billion Euros; these numbers where

revealed by the Greek Statistical Authority (ELSTAT) and the General

Accounting Office to Eurostat, during the interim Excessive Deficit Procedure.

The

same data show that the deficit for the year 2012 is expected to be around 13.4

Billion Euros, a target level that will

most likely be achieved through heavy public spending cuts. Specifically, from

a central government perspective, the deficit target is set at 11.4 Billion

Euros.

GDP

is also projected to decline to 194.7 Billion Euros, from approximately 232

Billion Euros (the GDP before the ΄΄invasion΄΄ of the IMF in Greece).

Furthermore,

according to data of ELSTAT, the deficit

in 2011 was 9.4% of GDP or 19.7 Billion Euros – with the deficit in 2010

being 10.7% (approx. 24 Billion Euros), and 15.4% in 2009 (approx. 36 Billion

Euros).

In

its statement, ELSTAT admits that the deficit and the public debt surpassed

expectations, partly because additional

government expenditures were found, and because the Agency revised the levels

of the GDP. And because GDP is the basis for measuring debt, the debt

levels have increased!”

Article

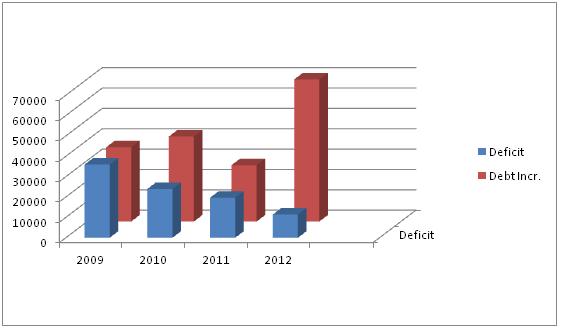

Regardless of the above

lightly formatted text (published by media), in general, the year by year increase in public debt of a country can be found, if the

year-end deficit (loss) is added to the previous year’s total debt. With

this in mind and using as our source the debt report of the Greek Ministry of

Finance, we get the following:

TABLE

I:

Development of the central government debt, approximate budget deficits, year

to year public debt increase (in million Euros)

|

Year

|

Central Gov. Debt

|

Deficit

|

Debt Increase

|

|

|

|

|

|

|

2008

|

262,070.75

|

-

|

-

|

|

2009

|

298,525.20

|

36,000.00

|

36,453.45

|

|

2010

|

340,286.00

|

24,000.00

|

41,761.80

|

|

2011

|

367,978.00

|

19,700.00

|

27,692.00

|

|

2012

|

343,230.00*

|

11,400.00

|

69,825.00

|

*PSI: 105,973

Million Euros

Source: Debt report,

budget draft 2013 (Greek Ministry of Finance)

As seen in Table I, in

2009, just before the invasion of the IMF, the Greek debt increased by 36.453

Billion Euros – that is, by as much as

the “swollen” deficit had increased, which was determined by the then newly

formed government (following irrational processes).

The next year however,

although the deficit dropped to 24 Billion Euros (it has been revised so many

times that it is hard to find the exact number – but it’s certainly possible), Greece’s debt increased by 41.7 Billion

Euros. Furthermore, in 2011, although the deficit of the country was 19.7

Billion Euros, its debt increased by 27.7 Billion Euros.

The year 2012 now, was

known for the notoriously criminal debt write-off (PSI), amounting to around

106 Billion Euros – at least as publicly announced. Therefore, compared to 2011, the debt in 2012 should

normally decrease by 106 Billion Euros, and increase by the years (2012)

deficit – that is by 11.4 Billion Euros.

As a consequence, the total debt ought to stand at 273.405 Billion Euros

(367,978 – 105,973 + 11,400) rather than at 340.6 Billion Euros announced by

ELSTAT or 343.3 Billion Euros according to the budget – a huge difference, amounting to 69.8 Billion Euros!

Now, baring in mind the reduced GDP that was announced (194.7 Billion

Euros), the total debt (343,2 Billion Euros according to the budget) will almost reach 176% of GDP – when

before the IMF (2009) and the debt write-off (106 Billion Euros), the total

debt was at 129.4% of GDP (113.0% in 2008, compared with a GDP of 232.9 Billion

Euros).

Perhaps we should note here that, because of the dependence the general

government revenue has to the levels of GDP (revenue of 52.85 Billion Euros,

compared to a GDP of 215.09 Billion Euros – 25% of GDP), only due to the drop of the GDP by 38.1 Billion Euros compared to 2008,

approximately 9.52 Billion Euros in revenues are lost annually.

Adding on top of that the government

expenses that are piling up due to the recession (unemployment etc.), the total revenue losses will compound to

more than 15 Billion Euros – a loss that comes as a consequence of the

imposed austerity policies (policies that accomplish only one purpose, the substantiation

of an economic genocide).

To carry on with our

discussion on public debt, it is obvious

that its disproportionate increase compared with the deficit of the country,

is due to some specific causes – causes that need to be publicly announced by

the Greek government so that all its citizens can be aware of them. Unfortunately,

as usual, this has not happened.

If we take a look at the

budgeting program of 2013, we will see that the public debt of 2012 was

burdened (in addition to the deficit of 13.3 Billion Euros) with 11 billion

Euros in losses of local governments and other governmental bodies, with 49 Billion Euros from the recapitalization

of banks, with 3.5 Billion Euros from the repayment of expiring liabilities to

the private sector, as well as with various other amounts to meet the needs

of the first quarter.

The Greek citizens

therefore, in 2012, paid 49 Billion Euros to Banks (a

total of 109.1 Billion Euros have been approved for the Banks through the FSF)

and 11 Billion Euros to social funds, as well as various other amounts, for which

they were completely unaware of. These facts fully justify that with the PSI,

Greece «put a bullet to its own feet».

To sum up, up until

January 2012, Greece has received a total of 73.2 Billion Euros (20.3 Billion

Euros from the IMF and 52.9 Billion Euros from the Member States) – while waiting for the «doze» of shame (31.5

Billion Euros). Against this amount, the damage done to the country because

of the recession, unemployment, income reductions, the stock market collapse,

business bankruptcies, falling prices in properties and so on, has surpassed in

value the amount of 800 Billion Euros.

It is obvious, that based

on the above handlings, the public debt of Greece will never be viable - as it will grow over time and at will, with

the help of the Chicago fella’s. Under this context, to vote on 11.5

Billion Euros in austerity measures, while taking on debts of 49 Billion Euros

to recapitalize Banks (and 60.1 Billion Euros more to come) is a reasoning that

defies intelligence.

Without expanding further

into details, from the concentrated information of this article we can see

Greece being completely looted by the IMF – with the artful use of statistical data, manipulation and propaganda.

We also realize what could happen to Spain or Italy, if the IMF was to invade,

and use the same methods it used on Greece.

Precisely for this reason,

both Spain and Italy avoid it by all means. On the contrary, the Greek government in 2010 allowed the

IMF to enter without any resistance, making it the Trojan horse for the

invasion of the Euro-zone (while today’s government continues tolerating

the invaders, adopting the submissive policy of «bowing»).

THE

METHODS OF THE IMF

From one of our older

articles, we recall the IMF’s attitude towards the invaded countries – which are being abandoned like juiced out

lemon-cups, after their public and private properties have been plundered.

“The Asian «tigers» in

1997, were forced to seek «help» from the firefighters of the IMF, who of

course worked to the benefit of the country that caused the fires. As natural, the

«Fund» reacted positively at start, and provided the demanded loans – since the true purpose behind this act,

was to protect banks, pension funds, investment funds, private speculators etc.,

that had invested in the Asian real estate bubble, from going bankrupt.

These investors later on (after getting liberated from their former destiny)

put all «bets» in the «bursting» of the bubble, a move that would cause a sharp

devaluation of the Asian currencies.

In agreement with the IMF,

the first loans were provided to be used by the governments of Indonesia,

Thailand and South Korea, for the repayment of foreign speculators. Shortly after, with speculators having been

payed off completely, the «shock therapy» followed. Local populations where

forced to follow a catastrophic austerity policy that led to a deep recession.

Salaries were cut to extreme low levels, spending on healthcare and education

was limited to a minimum, and lending to small businesses was stopped almost

entirely.

From South Korea to

Indonesia, hundreds of thousands of workers lost their jobs, driven into

unemployment, while rules where set that prohibited states from providing any

kind of assistance to the affected citizens. Many schools were closed, medicines in hospitals were hard to find, people

were dying in the streets, and crime surpassed even the most morbid imagination.

At the same time hunger and starvation maxed out. The entire middle class

sector – the winners of the previous decade – now ceased to exist.

As always, the weak lower

social classes suffered the most, while the looting of private property

(buildings, land, etc.), through excessive taxation (a technique currently

implemented in Greece), exceeded all expectations. Many utilities

«denationalized» (so did the banking system), passing on ownership to foreign multinationals

at bargain prices. The cost of living

soared, and public property fell into the hands of the invaders – always

publicly presented as completely legal and transparent business transactions.

The onslaught of the IMF

had finally nothing to envy compared to a conventional war – since it managed

to leave behind human wrecks and societies that will never recover from the shock of absolute misery and destruction.

In any case, the residents of the wider Asian region, will never forget the

torturing they suffered in the hands of the bloodthirsty mercenaries hired by

loan sharks, and who do not have any kind of moral barriers when executing the

incredible commands of their «shadowy» leadership” (currency effects).

FISCAL

POLICY AND GDP

Also from one of our older

articles, we note that as far as the debt is concerned, according to the IMF, austerity programs are now having different

effects in Europe than they had in the past. These effects are calculated by a multiplier,

that reveals the relationship between the fiscal policy and the respective GDP

(that is the effects the policy has on GDP).

In previous years, the

multiplier was around 0,5 – an index that shows that when the state cuts

spending by 1 Billion Euros, the GDP shrinks (recession) by 0.5 Billion Euros.

Today however, the IMF

believes that the multiplier is between 0.9 and 1.7. To elaborate, when the

multiplier is greater than 1, the total GDP declines more than the budget

deficit does (in the case of Greece, the

deficit declined by 25 Billion Euros while the GDP shrank by more than 30

Billion Euros – leading to a vicious cycle that will eventually push the

country into bankruptcy, if the implementation of austerity measures is not

immediately stopped). Table II will give us some insights:

|

Cuts in Spending

|

Multiplier

|

GDP decline

|

Revenue loss*

|

|

|

|

|

|

|

1,000,000,000

|

0.5

|

-500,000,000

|

-166,500,000

|

|

1,000,000,000

|

0.9

|

-900,000,000

|

-299,500,000

|

|

1,000,000,000

|

1.7

|

-1,700,000,000

|

-566,100,000

|

*Total

revenues of Greece are estimated to be 33.3% of GDP, compared with 32.9% in

Spain and 29.8% in Ireland. Note:

In the case of Greece, it seems that the IMF had initially estimated a rate of

0.5, but in the process the rate ended up being between 0.9 and 1.7.

The table above reveals to

us, that when a policy that focuses on austerity (similar to the one imposed on

the Euro-zone members running a deficit) is implemented, the debt to GDP increases over time rather than decreases – a

hypothesis that has been documented many times in Greece.

PS:

Greece erased (write-off) debts of 106 Billion Euros, thus hurting its image worldwide and scaring away investors without any

real benefit, since most of the debt erased came from its interior – Greek banks,

social security funds, private investors and other Greek organizations.

Due to the debt write-off

(PSI), Greece now has to recapitalize its banks and funds – for which it has signed a loan agreement,

equal to the amount of 109.1 Billion Euros (more than the 106 Billion Euros

of the write-off).

Furthermore, if the

recapitalization is done through the ESM, then it is very likely that Greek banks will end up in foreign hands, and

in the process will transform into small branches selling financial products –

along with the dismissal of thousands of bank employees. If this is not the

zenith of stupidity, how else can it be described?

Athens, 26.11.2012

Translation of original: Dennis

Viliardos

Vassilis Viliardos is an

Economist and an Author of several books on the Greek economic crisis. He has

earned his Economics degree in ASOEE (Greek University of Economics) and in

Hamburg, Germany. He lives in Athens, Greece.

Vassilis Viliardos is an

Economist and an Author of several books on the Greek economic crisis. He has

earned his Economics degree in ASOEE (Greek University of Economics) and in

Hamburg, Germany. He lives in Athens, Greece.